Lending Club went public today, which is a tremendous achievement for the team. I had the good fortune of meeting Renaud Laplanche, Lending Club’s founder and CEO, back in 2008. He chose me to join his board and lead the Series B investment in 2009 when I was a principal at our venture capital firm. At the time I was one of a few women VCs in the industry. Was Renaud unusually “gender-blind”? How do most entrepreneurs perceive female VCs today?

My curiosity got the better of me. So I surveyed nearly 400 entrepreneurs to answer three quick questions:

- When founding a company, do entrepreneurs prefer to work with a female or male VC?

- What do entrepreneurs think is the biggest advantage of working with a female VC?

- What do they think is the biggest disadvantage?

Let’s Do a Count

First, how many female VCs are there? According to Pitchbook, in the U.S., there are only 164 female VCs out of a total of 3,396. Pitchbook pulled the top 100 firms ranked by number of VC financings completed in the last year (since Dec. 7, 2013), then counted only partners at those firms who have at least one board seat on a portfolio company. This methodology separates out “partners” at firms with no investment decision-making responsibilities (like partners of marketing, finance, and investor relations). That means fewer than 5% of all deal-doing, board-serving VCs today are women.

Now let’s look at the number of female entrepreneurs. Out of 2,772 deals done as of June 30, 2014, 378 of them had a woman founder, or almost 14% of all deals. The good news is the number of deals with a woman founder is rising, year over year, although slowly, up from 11% in 2012 and 5% in 2008.

Who Answered Our Survey?

Here are some quick stats on the nearly 400 people we surveyed, using Survata, over the course of one week ending December 8th. We only surveyed people who answered “yes” to the question, “Are you familiar with venture capital?”

Gender:

Age:

- 18 to 24: 14%

- 25 to 44: 39%

- 45+: 47%

Founder experience:

- Have founded a startup: 62%

- Plan to found a startup in the next 2 years: 38%

Survey Results

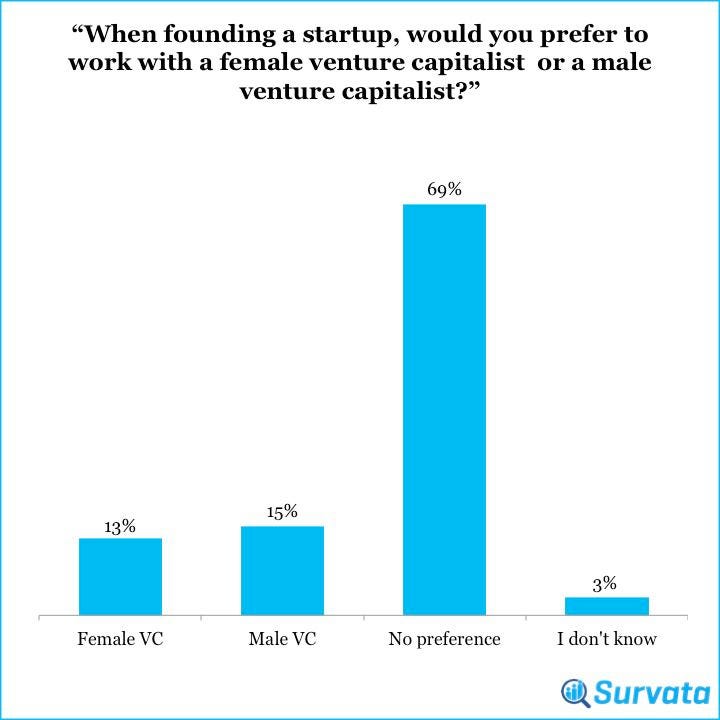

When founding a company, would entrepreneurs prefer to work with a female or male VC?

The vast majority (69%) said they had no preference. For those who did have a preference, 15% said male, while 13% said they prefer to work with a female VC.

What do entrepreneurs think is the biggest advantage of working with a female VC?

45% of respondents said there was no advantage to working with a female VC, or they didn’t know. This is interesting because, as noted in the data above, while a majority of respondents have no preference on who they work with, a majority (55%) still see at least one advantage to working with a female VC.

Of those who see an advantage, the majority (27%) thought the biggest advantage of working with female VCs was they bring a different worldview to the table – they see issues from a mother/daughter/wife’s perspective. The next biggest perceived advantage (13%) was female VCs soften the often “macho” tone of an all-male board.

What do entrepreneurs think is the biggest disadvantage of working with a female VC?

The majority of people (58%) didn’t know or didn’t believe there was a disadvantage to working with a female VC. Of those who had an opinion, 14% said the biggest disadvantage is female VCs are not as well connected as their male counterparts since most entrepreneurs and business executives are male. There was a tie for the next biggest perceived disadvantage: 10% of the respondents thought female VCs could make other male board members uncomfortable (e.g. male board members can’t speak freely for fear of being “un-PC”; and 10% thought women VCs could turn into “hysterical females” or be overly dramatic in crisis situations.

My Take on the Results

I’m heartened by the fact that the majority of entrepreneurs surveyed do not have a preference for either a male or a female VC. And, I agree with those who believe women VCs bring a different worldview as mothers, daughters, and wives, to the board table. In my opinion, more often than not, that perspective helps the company make better decisions – particularly at consumer-oriented startups. Lending Club, with Renaud at the helm, has an executive team of eight people – three of whom are women, including the chief financial officer, chief risk officer, and chief people officer. I am certain Carrie Dolan, Chaomei Chen, and Angela Loeffler add a level of discourse and insight to the Lending Club executive team that is invaluable. As for the Lending Club board, it is my hope that fellow female VC and board member, Mary Meeker of Kleiner Perkins, and I aren’t too shabby either.

Regarding the number-one perceived disadvantage that women VCs are not as well connected as their male counterparts, I could see how people might think that since most decision makers in the business world are men. However, my female VC peers at Scale, Canaan, Norwest, and other VC firms with women partners are as well connected as any VC that I’ve met over the years. In my own experience with Lending Club, and I think Renaud will attest to this, I introduced many senior hires through my own network that played a significant role in the company’s growth. Each successful introduction had as much to do with the size of my rolodex as it did my experience growing teams and identifying the right people for the right positions.

The United States Department of Labor categorizes a “nontraditional” occupation for women as one in which women comprise 25 percent or less of total employment. Venture capital, an industry where less than 5% of its partners are female, is therefore a nontraditional career for women. That said, to me, it’s one of the most exciting and rewarding jobs ever conceived. The best way to increase the number of females in the venture industry is simply by getting the job done, showcasing more role models, and doing what Renaud does naturally – that is, surround himself with people who are the best for the job, regardless of gender.

Rebecca Lynn is a General Partner at Canvas Venture Fund. Her early-stage venture investments at Canvas include FutureAdvisor, HealthLoop, Viewics, and CrowdFlower. Her investments while at Morgenthaler Ventures include: Lending Club, Check, RelateIQ, Doximity, Practice Fusion, Convo, and board observer roles at Adara and Socrata.

Source: here