Upwave Insights Report: How are consumers changing CPG buying behavior as a result of COVID-19? Unlike other periods of economic uncertainty, they’re turning to trusted brand names over store brands, despite tightening their budgets.

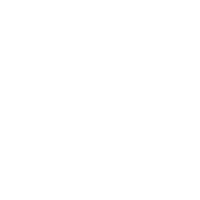

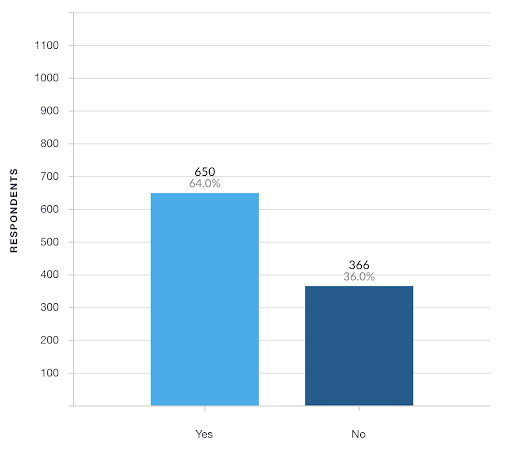

The study also uncovered the first indication that consumers are reconsidering their overall discretionary spending in light of COVID-19’s economic impact:

64% of US consumers are rethinking their total spending.

A majority are cutting between 10-20%.

Brand names versus store brands: Will COVID-19-created economic havoc follow previous economic uncertainty?

Often during economic uncertainty, generic products, “store brands” or “private labels” do better, so will that be the case with COVID-19? Turns out it depends wildly on your product category. Whether it’s because of safety, efficacy or other trust-related concerns, brands in categories like cleaning products, coffee or soda fared much better in Upwave’s study, while Americans were much less concerned about the brand of alcohol they drink or skin care they use.

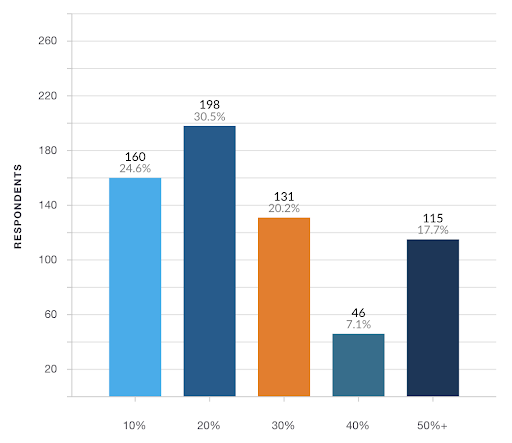

The one category that stood above all others was cleaning products, where U.S. consumers were very likely to buy brand-name products over private labels.

61% are likely or very likely to choose brand-name products, compared to only 39% that either don’t care or choose generics / store brands.

Other product categories where consumers favored brand-names included:

- Packaged foods (cereal, snacks, etc.): 58% are likely to buy brand-name products, compared to 42% that don’t care or choose generic / store brands.

- Frozen foods: 57% are likely or very likely to choose brand-name frozen foods, compared to 43% that don’t care or choose store brands / generics

- Soda, Coffee: Both product categories had 54% of Americans opting for brand-name products, compared to 46% that don’t care or choose generic / store brand alternatives.

Consumers Split:

Consumers were split on personal care products (shampoo, toothpaste, hair spray, etc), as 51% prefer brand name products, compared to 49% that either don’t care or will choose private labels. In a finding you might not expect during a health crisis, 50% of consumers were likely or very likely to choose brand-name over-the-counter (OTC) medications, with 50% not caring or choosing generic / store brand alternatives.

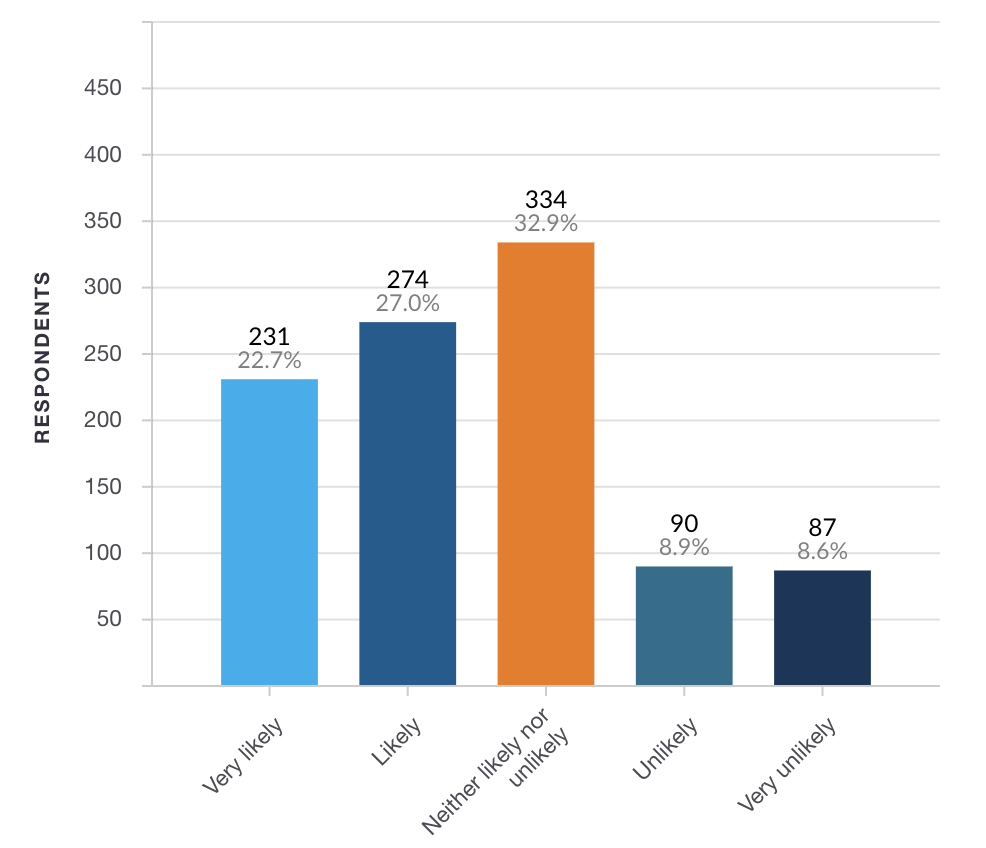

Alcohol tends to be where Americans care much less about the brand they want. Only 27% are likely or very likely to select brand-name liquor over store brands.

Beer and wine had similar results, along with skin care products.

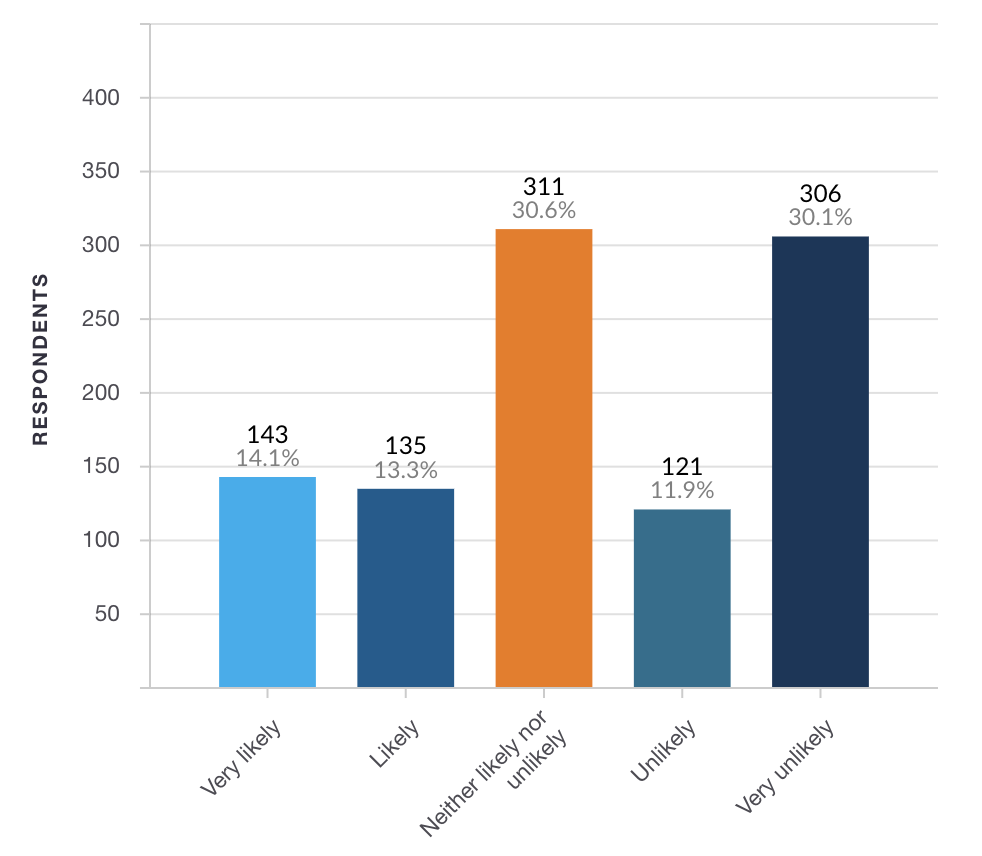

- Makeup / cosmetics / skin care: Only 28% of Americans said they were more likely to choose brand-name products during the pandemic, compared to 72% that don’t care or will choose generic / store brands.

- Wine / beer: Only 29% cared about preferred brand names compared to less costly store brand alternatives.

Some other notable findings within shopping behavior included:

- 39% of consumers indicated a product’s price as a big influencing factor behind their buying behavior.

- 64% noted perceived product availability as a big influence. In fact, 72% noted they are much more aware of product availability compared to before the COVID-19 pandemic.

- 20% will look for where the product comes from, whether that’s in a highly impacted region or not.

- 40% noted trust in brand as the biggest influencing factor driving purchasing decisions.

- Consumers are 3x as likely to be researching products compared to before the pandemic.

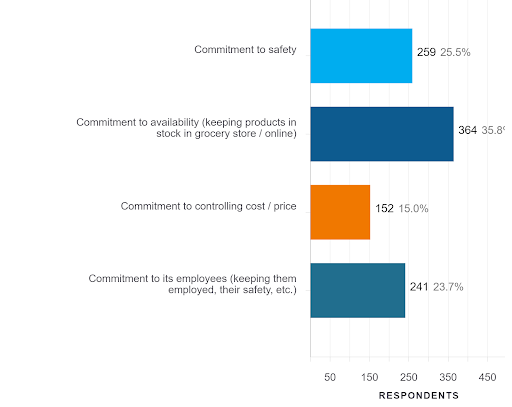

As many of America’s brand advertisers have adjusted their marketing to reflect COVID-19 sensitivity, Upwave also wanted to know what consumers think is the most important COVID-19 response message brands should communicate to customers during this pandemic. The top messages included:

- Commitment to product availability (36%)

- Commitment to product safety (25%)

- Commitment to brand’s employees (24%)

- Commitment to controlling price / costs (14%)

Upwave conducted the study in early April, interviewing 1,016 consumers through Upwave’s Digital Network, where consumers are interviewed in exchange for access to content or a service, such as free Wi-Fi. Consumers receive no monetary payment for their participation.